What is btob and btoc in gst.

If you’re looking for what is btob and btoc in gst images information linked to the what is btob and btoc in gst keyword, you have visit the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Introducing Magento Accelerators For B2b And B2c Thriving Businesses Magento B2c From in.pinterest.com

Introducing Magento Accelerators For B2b And B2c Thriving Businesses Magento B2c From in.pinterest.com

The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. These types of taxes paid on Consumption by the consumer but they do not pay directly to the government unlike income tax. In this video is only for the knowledge purpose. In a B2B GST invoice the name address and GSTIN or UIN of the customer must be mandatorily mentioned.

The new tax scheme has subsumed around 17 indirect taxes.

To be filled here These registered parties may be within state or outside state. We try to explain what is B2B and B2C role in GSTfor further detail please visit official website of GST. The OECD has also suggested and drafted two different sets of principles for cross border transaction to deal with B2C and B2B transactions. What are B2B and B2C Small and Large Invoice in GST How to fill Details of Debit Note and Credit Note in GST How to File GSTR - 3B Nil Return. Similarly goods or services sold to person who is another state with an invoice value more than 250000 then it is called B2CL.

Source: in.pinterest.com

Source: in.pinterest.com

The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. Similarly goods or services sold to person who is another state with an invoice value more than 250000 then it is called B2CL. B2B Invoices 4A4B4C6B6C It means Business to Business Invoice Details of Sales Made to Registered Parties having GSTIN No. Commerceacademy gstamendment gstr1In this video you learn GSTR 1 Amendment in the current GST returnIn this video you learn B2B B2C amendment in GSTR. B2C is another business model where a company sells goods directly to the final consumer.

What are B2B and B2C Small and Large Invoice in GST How to fill Details of Debit Note and Credit Note in GST How to File GSTR - 3B Nil Return.

B2C businesses sell products directly to the final consumers. Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace. The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. What are B2B and B2C Small and Large Invoice in GST How to fill Details of Debit Note and Credit Note in GST How to File GSTR - 3B Nil Return.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

Under GST system the following information explains about B2B and B2C. In a B2B GST invoice the name address and GSTIN or UIN of the customer must be mandatorily mentioned. Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace. B2C businesses sell products directly to the final consumers.

Source: in.pinterest.com

Source: in.pinterest.com

B2CS Means business to consumer small. GST The terms B2C and B2B are used very frequently these days these are stand for Business to Consumers and Business to Business. B2B is a business model where business is done between companies. What are B2B and B2C Small and Large Invoice in GST How to fill Details of Debit Note and Credit Note in GST How to File GSTR - 3B Nil Return.

Source: in.pinterest.com

Source: in.pinterest.com

The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. This video will be useful for making Corrections Modifications of B2B B2C Cr Dr Notes etc. A single common provision in GST will not be able to deal with these two transactions justly.

Similarly goods or services sold to person who is another state with an invoice value more than 250000 then it is called B2CL. B2C and B2B are totally different transactions as far as GST is concerned. For B2B supplies invoice wise details of both intra-state and inter-state supplies should be uploaded in GSTR-1 Return. Scanned Copies of invoices are not required to be uploaded in GSTR 1.

The new tax scheme has subsumed around 17 indirect taxes.

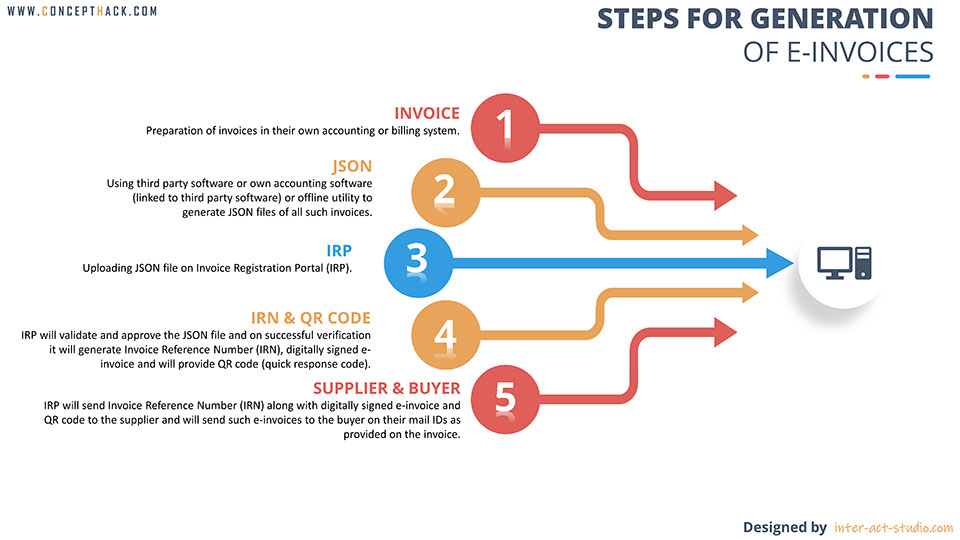

Of filed GSTR 1. B2C stands for Business to Consumer which is further categorised in two heads. B2B and B2 C Transaction. Differences between B2B-invoice QR Code and B2C Dynamic QR Code Posted by By Clearmytaxin Editorial Team September 16 2020 Posted in GST Articles We all know that effective from 1st October2020 GST e-invoicing will come into play wherein the suppliers who satisfy the specified conditions will be required to include a Quick Response QR code in all the GST invoices. A Helpful Guide for Consumers B2B and B2C.

Source: concepthack.com

Source: concepthack.com

Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace. B2CL means consumer large. The OECD has also suggested and drafted two different sets of principles for cross border transaction to deal with B2C and B2B transactions. Commerceacademy gstamendment gstr1In this video you learn GSTR 1 Amendment in the current GST returnIn this video you learn B2B B2C amendment in GSTR. Also after issuing an invoice the item level details pertaining to all B2B invoices must be uploaded to GSTN while filing GSTR-1 return.

In this video is only for the knowledge purpose. A Helpful Guide for Consumers B2B and B2C. In B2B both sales made to parties within the state as well as interstate are classified here. Similarly it also covers Mistakes Errors of FILED GSTR-1 on the GST Portal.

To be filled here These registered parties may be within state or outside state.

Of filed GSTR 1. Similarly it also covers Mistakes Errors of FILED GSTR-1 on the GST Portal. B2CS Means business to consumer small. Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace.

Source: legalwiz.in

Source: legalwiz.in

B2C and B2B are totally different transactions as far as GST is concerned. The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed. As per GST If any company or firm sold goods or services to public then it is called B2CS. In this form of commercial transactions goods and services are marketed to individual consumers.

Source: in.pinterest.com

Source: in.pinterest.com

B2B is a business model where business is done between companies. B2B focus on the relationship with the business entities but B2Cs primary focus is on the product. B2CL means consumer large. Yes we can use Separate Invoice Numbers for B2B B2C Type Invoices in GST You have to mention the Invoice Numbers while B2B Purchases and also mention the Invoice Number Range by mentioning the starting Invoice of particular month last Invoice.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

In B2B the customer is business entities while in B2C the customer is a consumer. For B2B supplies invoice wise details of both intra-state and inter-state supplies should be uploaded in GSTR-1 Return. This video will be useful for making Corrections Modifications of B2B B2C Cr Dr Notes etc. The OECD has also suggested and drafted two different sets of principles for cross border transaction to deal with B2C and B2B transactions.

B2B Invoices 4A4B4C6B6C It means Business to Business Invoice Details of Sales Made to Registered Parties having GSTIN No.

Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace. In this video is only for the knowledge purpose. B2C stands for Business to Consumer which is further categorised in two heads. In B2B the customer is business entities while in B2C the customer is a consumer. As per GST If any company or firm sold goods or services to public then it is called B2CS.

Source: tyasuite.com

Source: tyasuite.com

B2C and B2B are totally different transactions as far as GST is concerned. Of filed GSTR 1. Similarly goods or services sold to person who is another state with an invoice value more than 250000 then it is called B2CL. These types of taxes paid on Consumption by the consumer but they do not pay directly to the government unlike income tax. B2C and B2B are totally different transactions as far as GST is concerned.

GST The terms B2C and B2B are used very frequently these days these are stand for Business to Consumers and Business to Business.

In B2B the customer is business entities while in B2C the customer is a consumer. B2B and B2 C Transaction. B2C stands for Business to Consumer which is further categorised in two heads. In B2B the customer is business entities while in B2C the customer is a consumer.

Source: legalwiz.in

Source: legalwiz.in

A single common provision in GST will not be able to deal with these two transactions justly. B2CS Means business to consumer small. The OECD has also suggested and drafted two different sets of principles for cross border transaction to deal with B2C and B2B transactions. GST The terms B2C and B2B are used very frequently these days these are stand for Business to Consumers and Business to Business.

Source: in.pinterest.com

Source: in.pinterest.com

In this form of commercial transactions goods and services are marketed to individual consumers. In this video is only for the knowledge purpose. B2C stands for Business to Consumer which is further categorised in two heads. B2CS Means business to consumer small.

Source: in.pinterest.com

Source: in.pinterest.com

This video will be useful for making Corrections Modifications of B2B B2C Cr Dr Notes etc. B2CL means consumer large. Yes we can use Separate Invoice Numbers for B2B B2C Type Invoices in GST You have to mention the Invoice Numbers while B2B Purchases and also mention the Invoice Number Range by mentioning the starting Invoice of particular month last Invoice. Of filed GSTR 1.

The video covers LIVE DEMO of Corrections in GSTR-1 of the earlier month filed.

B2B stands for Business to Business. GST Goods and services tax is a major tax reform implemented in India on 1st July 2017 across all the states. B2C stands for Business to Consumer which is further categorised in two heads. B2C and B2B are totally different transactions as far as GST is concerned. A Helpful Guide for Consumers B2B and B2C.

Source: blog.saginfotech.com

Source: blog.saginfotech.com

These types of taxes paid on Consumption by the consumer but they do not pay directly to the government unlike income tax. B2B stands for Business to Business. In B2B the customer is business entities while in B2C the customer is a consumer. B2C and B2B are totally different transactions as far as GST is concerned. GST The terms B2C and B2B are used very frequently these days these are stand for Business to Consumers and Business to Business.

The new tax scheme has subsumed around 17 indirect taxes.

GST Goods and services tax is a major tax reform implemented in India on 1st July 2017 across all the states. Business-to-consumer B2C is a sales model in which products and services are sold directly between a company and a consumer or between two consumers in a digital marketplace. Similarly goods or services sold to person who is another state with an invoice value more than 250000 then it is called B2CL. In a B2B GST invoice the name address and GSTIN or UIN of the customer must be mandatorily mentioned.

Source: tyasuite.com

Source: tyasuite.com

B2C is another business model where a company sells goods directly to the final consumer. Scanned Copies of invoices are not required to be uploaded in GSTR 1. Under B2B those sales transactions or invoices are classified which are made to registered persons ie person having GSTIN No. In B2B the customer is business entities while in B2C the customer is a consumer. B2C and B2B are totally different transactions as far as GST is concerned.

Source: in.pinterest.com

Source: in.pinterest.com

As per GST If any company or firm sold goods or services to public then it is called B2CS. What are B2B and B2C Small and Large Invoice in GST How to fill Details of Debit Note and Credit Note in GST How to File GSTR - 3B Nil Return. Of filed GSTR 1. As per GST If any company or firm sold goods or services to public then it is called B2CS. GST Goods and services tax is a major tax reform implemented in India on 1st July 2017 across all the states.

Source: in.pinterest.com

Source: in.pinterest.com

B2C stands for Business to Consumer which is further categorised in two heads. B2C businesses sell products directly to the final consumers. To be filled here These registered parties may be within state or outside state. B2B focus on the relationship with the business entities but B2Cs primary focus is on the product. B2C stands for Business to Consumer which is further categorised in two heads.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is btob and btoc in gst by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.